Government Certificate of Release of a Motor Vehicle. This includes all vehicles transferred with a U.S. Vehicle Identification Number (VIN) Inspection (§66-3-4(B))Īll used vehicles with titles from any state other than New Mexico, being registered and titled in New Mexico for the first time, shall be visually inspected, by a certified VIN inspector to verify that the vehicle identification number (VIN) on the Certificate of Title corresponds with the vehicle.The odometer statement is required on all motor vehicle title transactions, except off-highway vehicles. they must have language stating that mileage is actual (AM), exceeds mechanical limits (EL), warning odometer discrepancy (NM), or exempt (EX). The odometer mileage statement can be attested to in the assignment on the back of the New Mexico Title, on MVD Form 10009 “New Mexico Motor Vehicle Bill of Sale,” on MVD Form 10187 “Odometer Mileage Statement” or MVD Form 10001 “Application for Title and Registration.” Odometer mileage disclosure statements may be accepted provided that they conform to federal standards, i.e. Odometer Statement (§§ 66-3-4, 66-3-10, 66-3-101(A), 66-3-107(C) and 49 CFR 580.5)Federal and state law require that the transferor of a motor vehicle attest to the accuracy of the odometer mileage reading at the time of the vehicle’s sale, transfer or assignment.NOTE: An “Intent to Purchase” document cannot be accepted as a purchase agreement or dealer’s invoice. If taxes are paid to an out-of-state dealer.The net sales price less any discounts.The gross sales price before trade-in deduction, if any.A description of any trade-in vehicle including VIN.A description of the vehicle including year, make, and VIN.

However, if any taxes are paid out-of-state a certified copy of the purchase agreement or dealer’s invoice must be provided.The purchase agreement or dealer’s invoice must show the following: new car/truck MSRP value of the vehicle). A non-certified copy will be accepted if the sale price conforms to the NADA Retail Pricing Index Guide (i.e. This document is essential for the computations of the excise tax, based upon the net sale price of the vehicle.

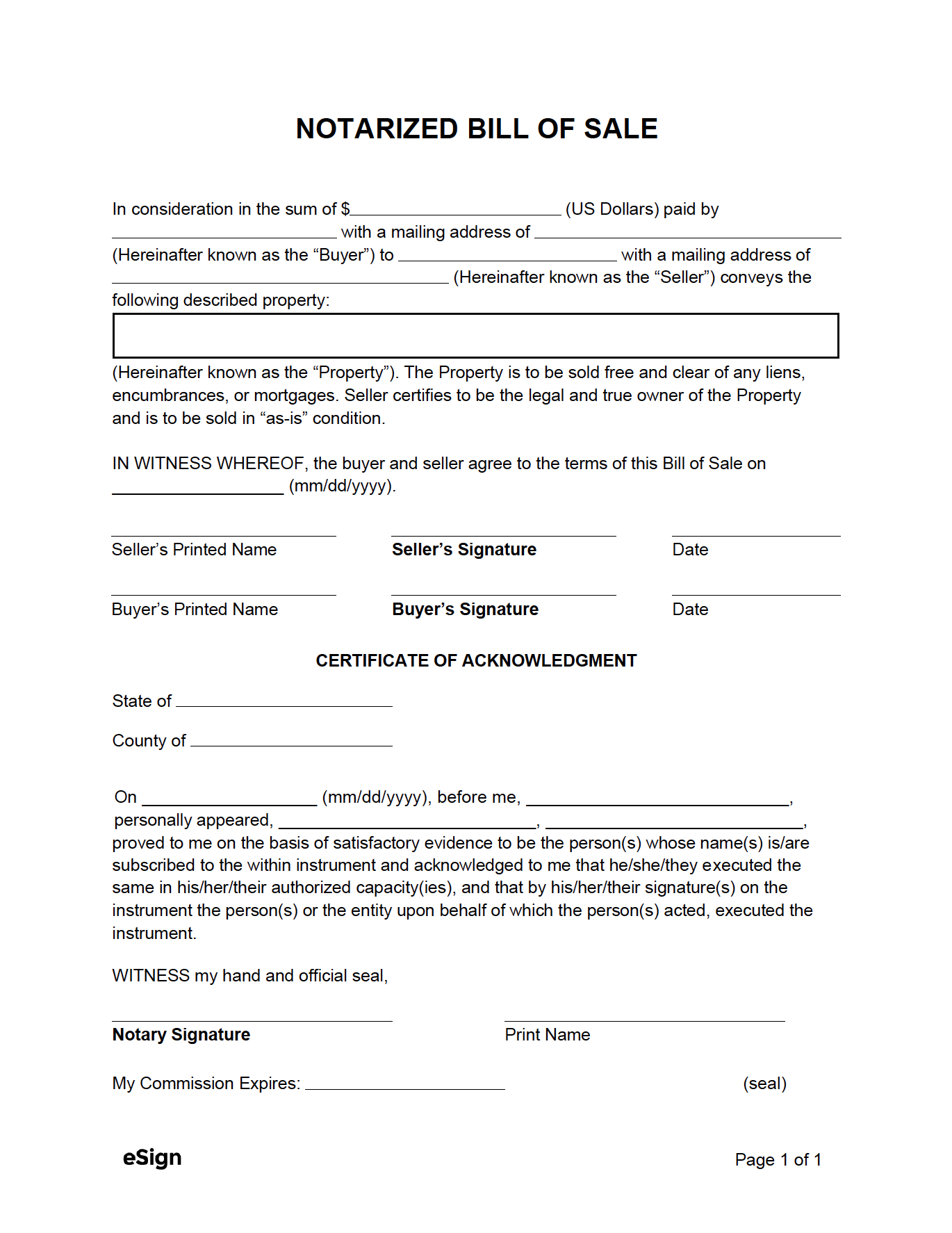

The purchase agreement or dealer’s invoice must be the original or a certified copy. Purchase Agreement/Dealer’s InvoiceThe purchase agreement or dealer’s invoice is required on every title transaction involving a dealer sale, including purchases from out-of-state dealers.If the vehicle is a surplus vehicle from the Federal Government, the Bill of Sale must correspond with the Certificate of Title or U.S. The Bill of Sale must be completed by the seller and include all vehicle information (year, make, VIN, sale price, seller’s name, address and signature, buyer’s name, address and signature). The Bill of Sale ( MVD-10009) shall also be used to carry out a transfer in transactions between individuals, when the assignment on the reverse side is incomplete. Bill of Sale On a dealer transaction, when the assignment on the reverse side of the Certificate of Title is incomplete or there is no more room on the back of the title to make an assignment, a Bill of Sale ( MVD-10009) shall be used to complete the transaction.Photocopies are not acceptable for processing any type of title transaction. Certificate of Title (§66-3-10)The current outstanding Certificate of Title is the primary document when transferring ownership of a used vehicle.Section A: Documents Required to Title and Register a Used Vehicle Documents Required to Title and Register a Used Vehicle

0 kommentar(er)

0 kommentar(er)